Your challenges

The economic impact of the recent healthcare crisis, the fast-tracking of digitalisation and the need to analyse data are forcing financial management to transform from a simple accounting approach to a management approach.

Not only is the responsibility to follow indicators or comply with regulatory obligations worthwhile, your teams are nowadays the guarantee of control to participate fully in financial and strategic decision making.

The role of the treasurer

In this context, the role of the treasurer is moving towards a more cross-cutting function with processes and tools that need to evolve in order to gain in productivity, control, reliability, decision and security.

PRODUCTIVITY

To optimise cash management. Automation of bank communication, GL and treasury reconciliation, accounting of financial transactions.

CONTROL

For your internal cash flows. Global compliance, traceability, security and auditing of treasury processes. Sarbanes-Oxley.

DECISION

To increase the global visibility over your cash. Make the best investment or financing decisions. Know your bank business to define strategic bank relationships.

SAAS TECHNOLOGY

Software-as-a-Service (SaaS) is a pay-as-you-go model that frees the treasurer from the burdensome and costly version upgrades of the traditional licensing mode. The combination of SaaS model, Technology and Service, offers high up-time, scalability and security.

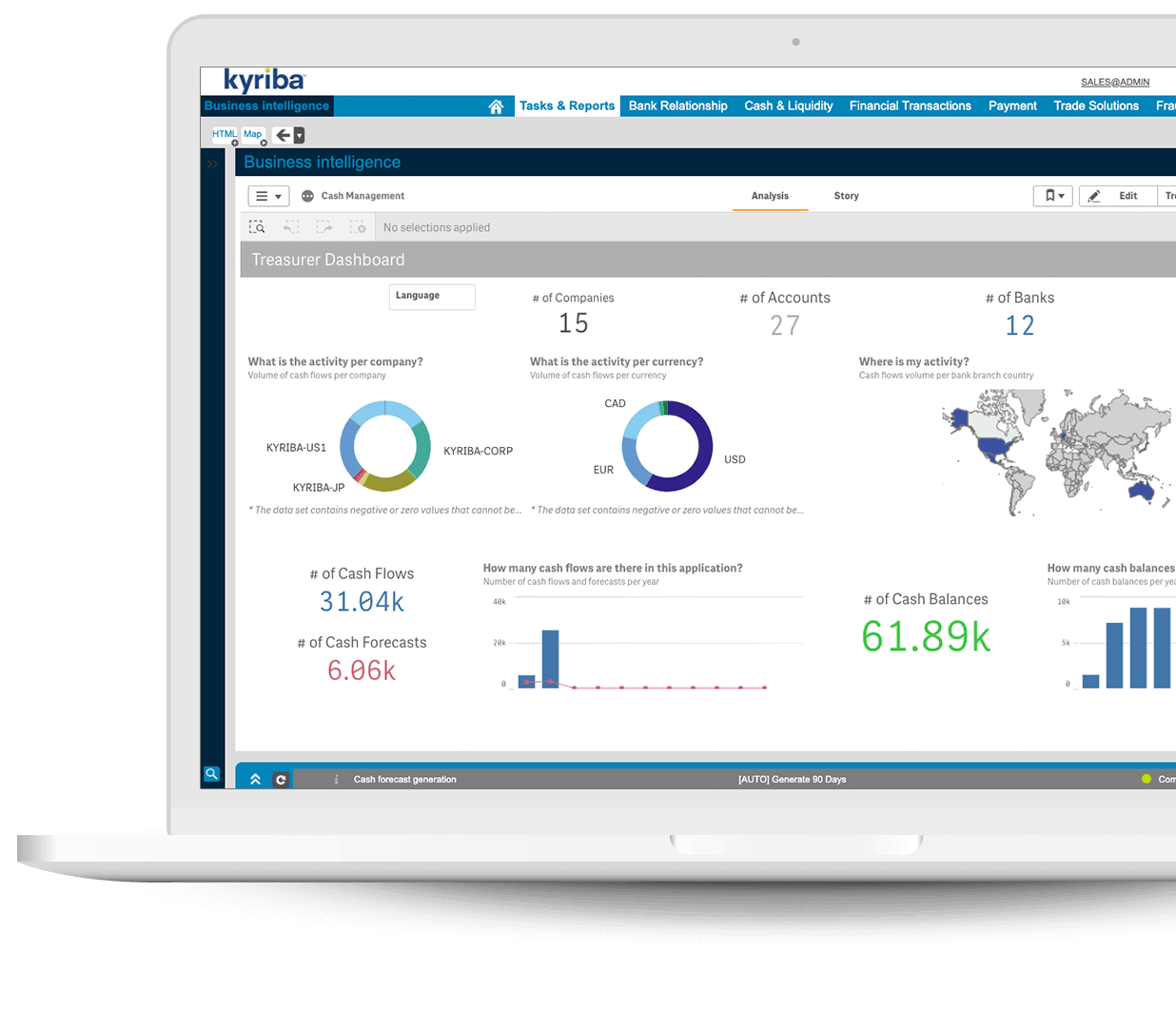

Obtain a strategic vision in real time

The volatility of the financial markets, low interest rates that force companies to review their cash allocation and arbitrage policies, the increase in fraud attempts and the modernisation of payment methods, require companies to have clear visibility of their cash cash and reliable and powerful tools to gain in productivity and security.

Finding a partner with modern solutions to ensure the financial security of your company and control your financial, operational or non-compliance risks is an essential goal for your company.

Unlimited access from any device

Would you like to know the full potential of our Cash Management Solutions?

Our experts in each area of expertise are available for a customised demo.